Finance Meets GTM - How to Align for Growth

RevGenius webinar recording that discusses how best to align finance and GTM teams in order to establish optimal GTM plans.

A white paper describing how to overcome the disparity between GTM and Finance teams objectives.

In the world of B2B SaaS and managed service providers lives an obvious issue. Finance and go-to-market teams speak completely different languages and view the business from equally different perspectives. Ultimately, they both want to grow the business, but see the path to growth very differently. Compounding issues, one organization’s perception of the other is often tainted. Finance sees GTM teams as a cost center, always needing to spend money to make money. GTM teams see finance as inhibitors to growth blocking access to funds with the thinking that saving money is the same as making money. Oil and water.

Bridging this gap and creating alignment is 100% within an organization’s control…we can’t change external macroeconomic conditions and the impact on buyer behavior, but we CAN get GTM teams and finance to use the same vocabulary and align on an optimal path to hitting revenue growth targets. Both teams have enough battles to fight, it’s time they join forces.

Finance and go-to-market strategies may seem like two completely different worlds, but both play equally significant roles within a company. Finance teams deal with budgeting, forecasting, and managing cashflow so the company can continue to operate, while go-to-market strategies focus on marketing, sales, customer retention and creating value for customers and the company. Finance cares about the bottom line. GTM teams care about the top line. Traditionally, these two departments have operated in silos, resulting in missed opportunities and inefficiencies.

With that said, these competing views are critical to helping an organization maintain balance between financial objectives and what it takes to actually acquire and retain customers. What is needed is a holistic integrated view into how finance and GTM teams can achieve their common goal, creating sustainable revenue growth for the business.

To be clear, it's not about erasing boundaries; it's about creating bridges that connect the dots between finance and go-to-market, enabling better decisions that drive growth.

How do we get GTM and finance teams on the same page? It starts with a common view of an organization’s revenue goals with direct line of sight into GTM performance targets that, when achieved, lead to hitting those revenue goals. This diffuses the age-old argument that traditionally starts with the question “why are we spending money on this campaign or attending that event?”. When we say “a common holistic view” what we mean is the ability to draw a clear line from a revenue goal, to the GTM activity required, to the cost for executing that activity. Ultimately providing the ability to visualize how an investment today will result in revenue tomorrow.

Let’s take a simple example, the GTM team approaches finance with a request to fund new demand generation programs in Q3 and Q4 with the objective of generating leads that will support bookings goals in Q1 of the following year. On the surface, the finance team may rightfully push back on expending funds in one year to benefit a subsequent year.

Fig 1: Timeline for GTM Performance Targets Aligned with Expected Wins

But with visibility into why the timing of the investment is critical, based upon historical sales cycles (even adjusted for shifting market conditions), the finance team can understand why an investment today is warranted.

Flipping our example, finance can also provide GTM performance targets aligned with revenue growth goals. Let’s say the finance team has been asked to build a plan that will show Annual Recurring Revenue (ARR) growth from $5M in 2023 to $10M in 2024. An aggressive growth trajectory. With knowledge of how GTM teams generate interest and how long it takes to convert that interest into a paying customer we can predict the volume of leads required to achieve those growth targets and by when.

Fig 2: Alignment Between ARR Growth Goals & Marketing Qualified Lead Generation

By fostering alignment between finance and go-to-market teams, organizations can leverage the unique strengths of each to drive better more predictable outcomes. Not only that, but we also create a common vocabulary that speaks to achieving a common goal. Here's why bridging this gap is worth the effort:

Finance is at the intersection of everything a business does today with their role evolving from crunching numbers in spreadsheets to delivering proactive guidance to the business across departments. The issue, the vast majority of finance leaders will tell you they are making decisions based upon inaccurate or incomplete data. Meaning they struggle to confidently provide guidance on strategy and steer the company to better, data-driven decisions.

Connecting GTM plans with finance’s growth models drives the business to more informed decisions from pricing, to resource allocation, and the execution of supporting GTM motions. Insights from the GTM team creates confidence that our plans for acquiring customers align with financial objectives, maximizing returns while minimizing risk.

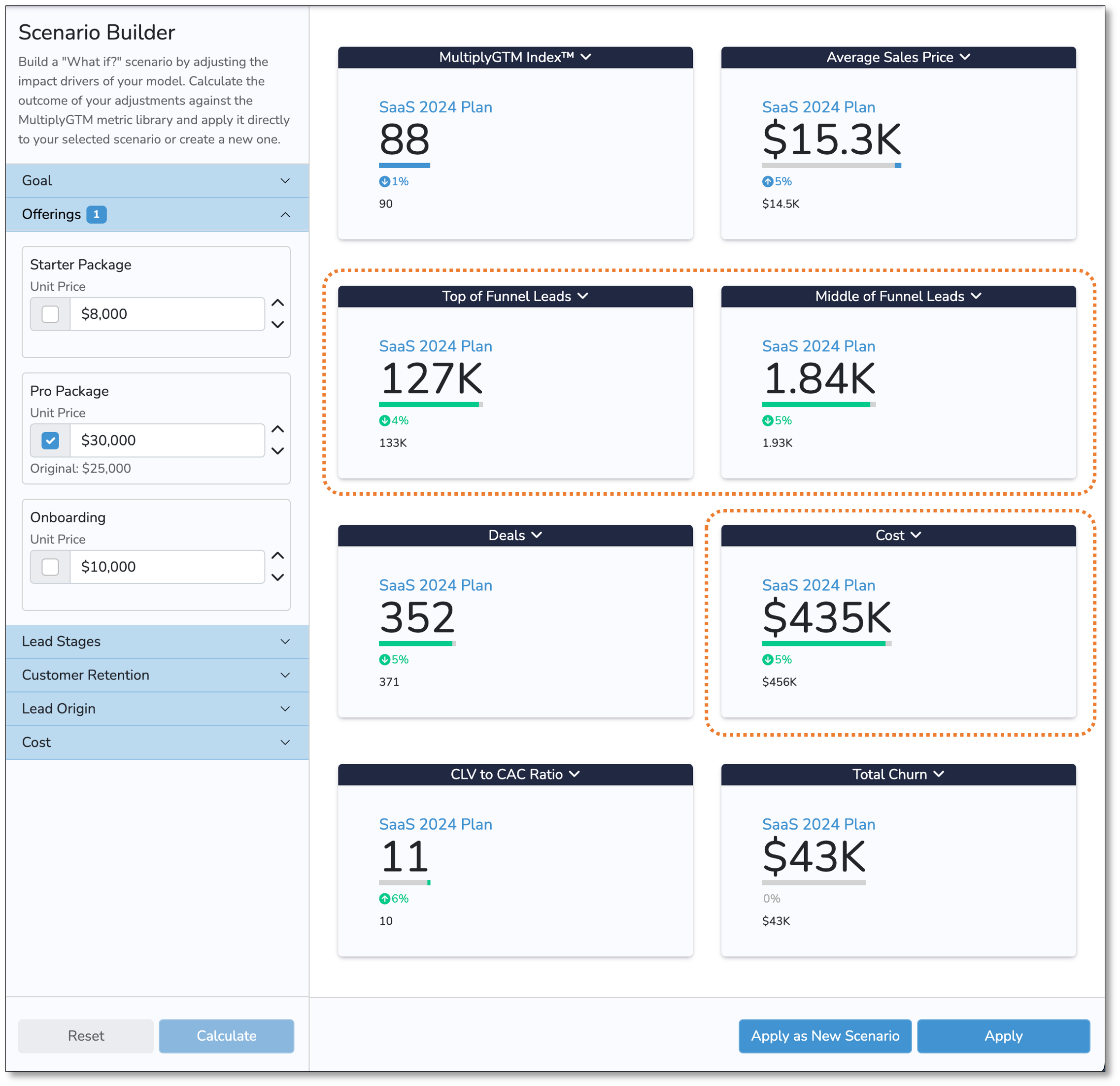

For example, GTM teams can help finance understand how a change in pricing would impact the path to achieving top-line revenue goals and the resultant change in total customer acquisition cost. In the scenario below, the GTM team is modeling the impact of a 20% increase in pricing for their “Pro Package” subscription. The impact is a 4% reduction in required lead volume and a projected 5% reduction in total customer acquisition cost. This highlights the non-linear relationship between all the variables in your GTM plan, variables the finance team may not be aware of.

Fig 3: Impact of Increasing “Pro Package” Price by 20%

Finance teams have a holistic view of the organization's financial landscape. By collaborating with go-to-market teams, they can provide guidance on allocating resources effectively. This ensures that budgets are optimized, and investments are made strategically, resulting in improved go-to-market outcomes. Conversely, GTM teams can help finance understand what is “reasonable” to deliver on revenue targets.

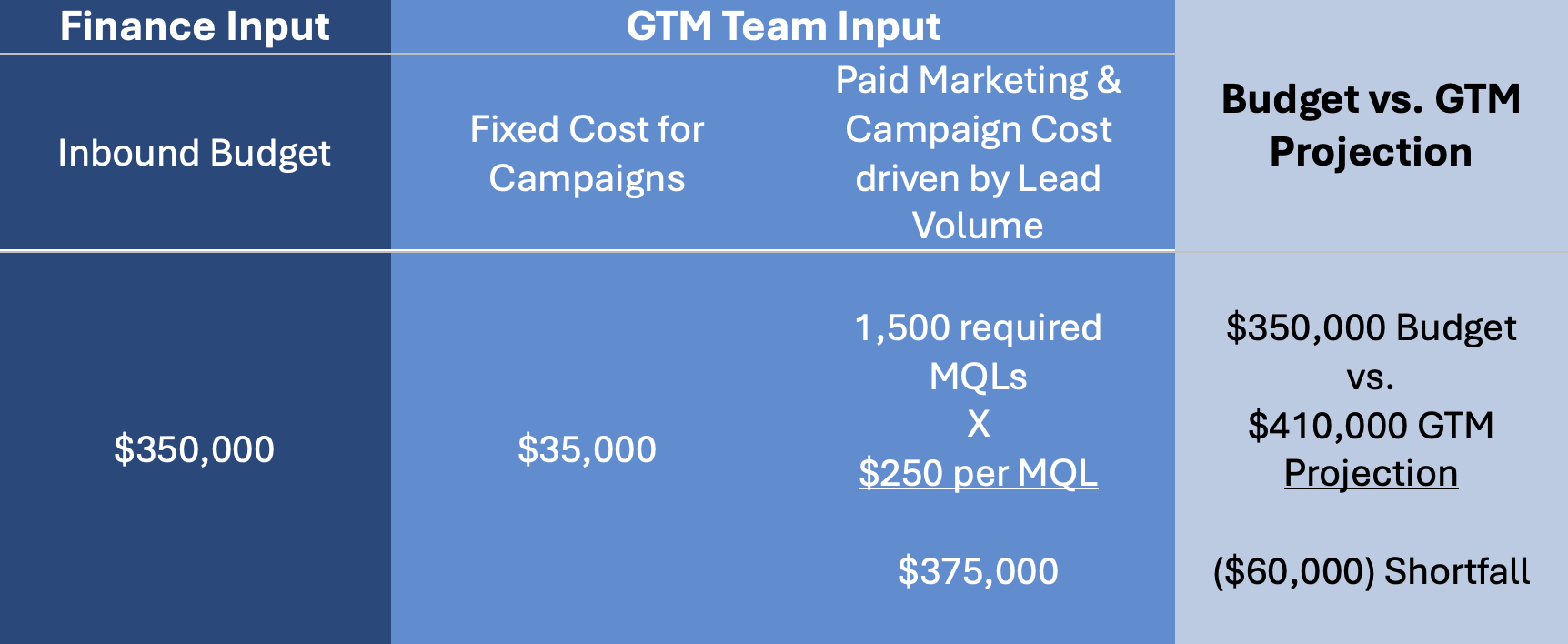

We all are faced with delivering revenue with limited resources and funds. Finance holds the keys to budgets while GTM teams are tasked with responsible use of that budget. Imagine finance and marketing teams collaborating on the best use of a company’s resources to achieve revenue goals. Take for example a $350K marketing budget for inbound demand generation campaigns. On the surface it seems like a reasonable budget to finance, but that value is often set without visibility into the volume of leads required from the GTM team.

Fig 4: Rationalizing Budget vs. GTM-driven Projections

With an understanding of historical conversions and associated cost per lead finance and GTM teams can confidently establish a budget that meets both team’s needs. Providing visibility into the rationale behind what that budget should really be based upon historical campaign performance, conversions, and cost.

By integrating financial objectives into go-to-market strategies, organizations can continuously evaluate their performance. GTM teams can provide insight into performance beyond “did we hit our sales goals?” by sharing the performance targets that lead to revenue. Not just real-time, but in time so that finance and GTM teams can work together to course correct or capitalize on an unforeseen opportunity. Simplifying information into actionable insights so that the best decision becomes clear.

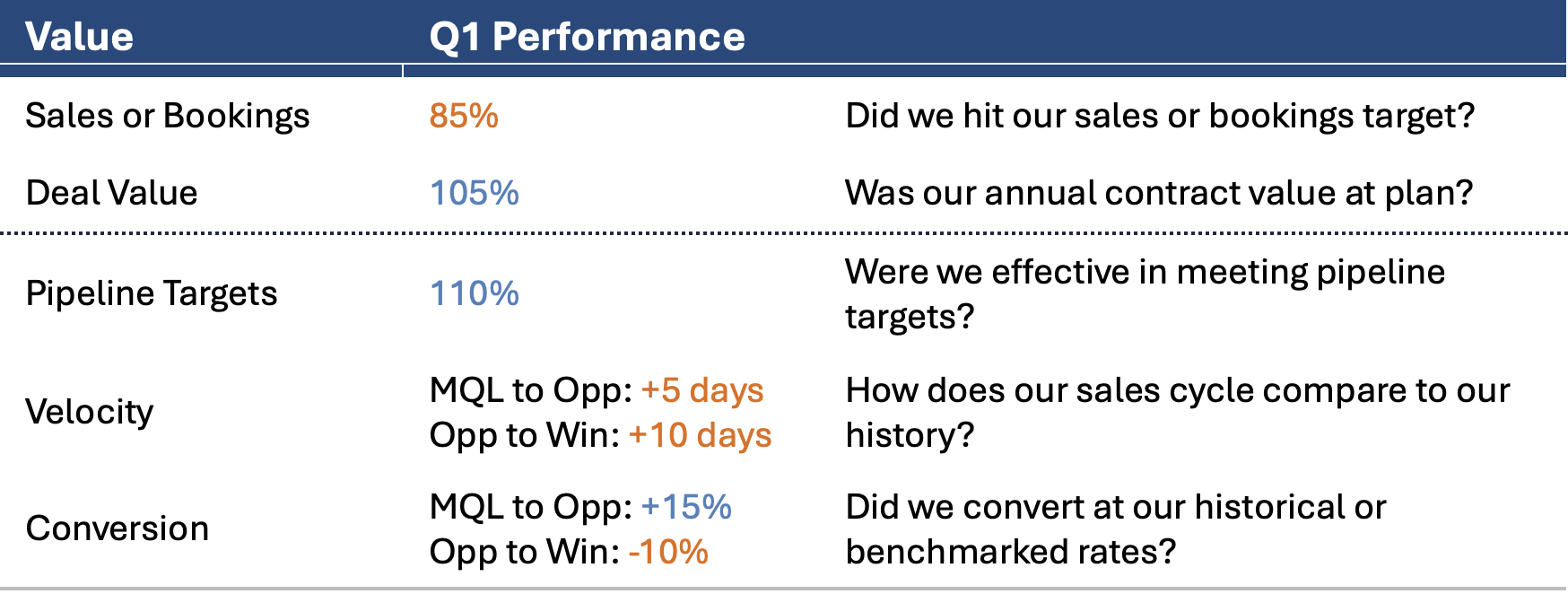

Simple is the key. In our basic example below, we see that we missed our sales goal by 15%, achieving 85% of plan. But our annual contract value was higher than originally planned by 5%. Leveraging GTM-related insights we no longer have to guess what happened.

While we achieved our pipeline targets, our sales cycle extended by 5 days when converting an MQL to an opportunity, and by 10 days when converting an opportunity to a win. This combined with a lower-than-planned opportunity-to-win conversion are the clear drivers of our Q1 performance. It took longer to convert, and the conversion rate was lower than historical performance.

Now we can dig into the details as to why this happened and how to improve. Can we be more efficient in the sales cycle by shaving 1-2 meetings off the sales process? Is the fact that our MQL-to-opportunity conversion rate was HIGHER than plan tell us we aren’t disqualifying poor fit leads before they make it to an opportunity, ultimately impacting our subsequent opportunity-to-win conversion? It gives us the chance to ask better, more informed questions. Additionally, if we monitor these GTM performance targets on a monthly or weekly basis, we buy the time to take corrective action before we miss our sales goal.

Fig 5: Evaluating Performance

Misaligned finance and GTM strategies combined with the pressure to drive results creates an environment where teams may sacrifice long-term goals for short-term results. Connecting GTM performance targets with finance’s revenue growth targets drives confidence across the entire organization. Creating a shared understanding and a common vocabulary that fosters accountability and a sense of collective responsibility.

This means moving beyond basic sales or bookings targets to the performance metrics that act as leading indicators to sales. It requires sharing data in a clear concise way so organizations can readily align on revenue goals, GTM performance targets, and make better data-driven decisions about when, where, and how to invest in growth.

This is exactly what we are helping organizations accomplish with MultiplyGTM.

RevGenius webinar recording that discusses how best to align finance and GTM teams in order to establish optimal GTM plans.

Next generation GTM planning. Build GTM plans that truly account for how well you are able to perform.

We are constantly pushing the boundaries with thought provoking concepts and ideas. Be the first to hear about our latest publications.

Visit our Knowledge Library